Demand for high-quality office space is squeezing limited supply, particularly in prime city centres.

According to JLL’s recent research, new office construction in Europe has dropped 24 percent since 2020 and reached its lowest level in over a decade in early 2025. This scarcity, in turn, is reshaping occupier preferences and opening the door for strategic retrofitting as a smart, compelling solution.

As ground-up development slows and rents climb, JLL’s analysis highlights an alternative: upgrading existing mid-tier office stock.

Retrofitting costing between 3 percent and 12 percent of an asset’s value can deliver significant rental premiums without the delays or expense of new construction.

Retrofit Gains: Rental Uplift and Yield Potential

Upgrading existing office buildings can command a substantial rent boost. For example, in London, elevating a property from “Silver” to “Platinum” quality has produced an average uplift in rents of 29 percent. A similar trend, though with slightly more variation, is seen across key European cities.

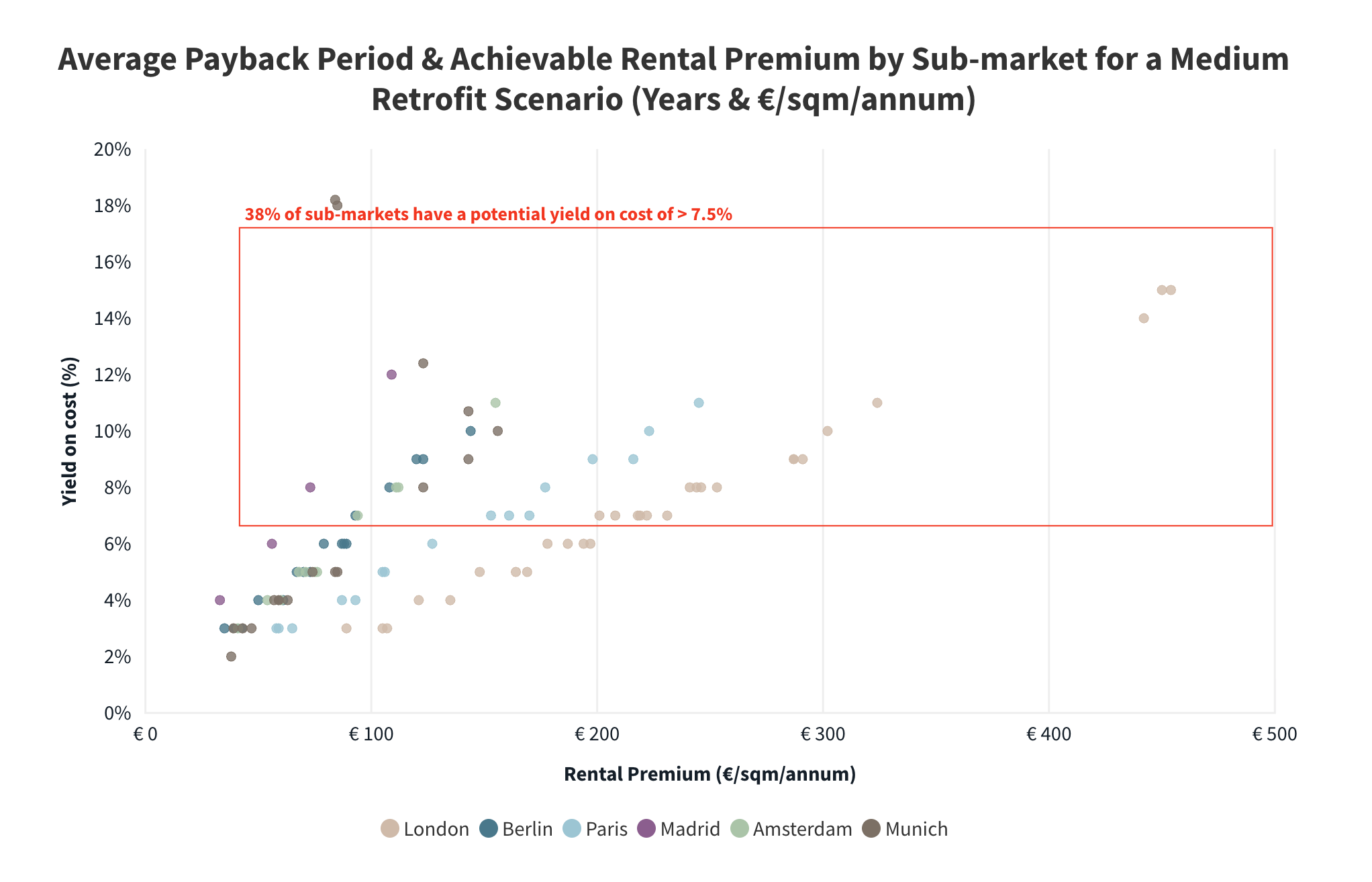

JLL’s comprehensive examination of markets such as Amsterdam, Berlin, London, Madrid, Munich, and Paris show that 38 percent of submarkets offer a yield on cost of 7.5 percent or higher, and capital expenditure payback periods can fall below 10 years.

Retrofit Strategies to Enhance Asset Value

JLL places retrofit in the gap between light refurbishment (repainting walls, replacing carpet etc) and replacement (demolish and construct new), in which there are 3 subcategories:

Light Retrofit

- Measures implemented with little to no disruption to occupants, minor upgrades, single aspect.

- Cost: 3% – 4% of asset value

- Examples: LED upgrades (as we did for Civil Society Media), BMS optimsation and smart mechanical systems.

Medium Retrofit

- Substantial interventions, moderate disruption, mechanical, electrical and plumbing.

- Cost: 5% – 8% of asset value

- Examples: HVAC, replacement MEP systems, BMS replacement.

Deep Retrofit

- Extensive transformation, significant disruption, structure, systems, services and function.

- Cost: 9% – 12% of asset value

- Examples: Major structural upgrades, renewable energy.

Submarket Diversity: Emerging Opportunities

Not all locations yield the same returns. In London, yield on cost spans 3.5 percent to 16.5 percent. In Paris, moderate retrofit costs (around €2,300 per square meter) produce yields ranging from 3 percent up to more than 10 percent, depending on location, and in Madrid and Amsterdam can reach up to 11 percent.

These findings underline an important principle. While core, high-rent areas often generate the highest returns, emerging submarkets offer untapped potential, especially for tailored, lighter-touch retrofits that reemerge as attractive offerings for boutique tenants.

Why Retrofitting Makes Financial Sense

The financial rationale for office retrofits is compelling. Rental uplifts between upgraded quality tiers Silver to Platinum, for instance, can reach up to 40 percent. But the benefits extend well beyond rent:

- Capital appreciation

- Lower operating and vacancy costs

- Avoidance of carbon taxes

- Broader tenant appeal thanks to improved asset quality

In a market where new supply is scarce and development timelines risk obsolescence, such strategic investments not only preserve asset value but also offer a forward-looking answer to occupier demands and the ever-growing focus on ESG.

Conclusion

JLL’s in-depth research demonstrates that strategic retrofitting stands out as an economically attractive and timely strategy in addressing Europe’s tight office market.

With new construction at historic lows and occupiers seeking quality in less conventional locales, upgrading existing buildings allows stakeholders to unlock robust returns, deliver tenant value, and navigate supply shortfalls.

At Constructive Space, we have a long-history of retrofitting office space for both landlords and occupiers. With our directly employed tradesmen, we have the resources to strategically enhance asset value. Please don’t hesitate to get in touch for a chat with one of our Project Directors.